Generating

IR56E Tax form

Make sure you have completed following session(s)

l How

ecPayroll system handles HK taxation

In Hong

Kong, employers are required to submit the tax information of new join staffs to government within the first 3 months of

employment. It can be done by printing the IR56E report and send to the Inland

Revenue Department (IRD) by post or delivery in person. Before that, you

must get the approval from IRD to submit computerized IR56E form. See the

diagram below.

Steps

|

|

NOTE |

Before

export IR56E from ecPayroll system, make sure all required personal

particulars (e.g. Name, HKID, Address, …) are correct for all active

employees |

1

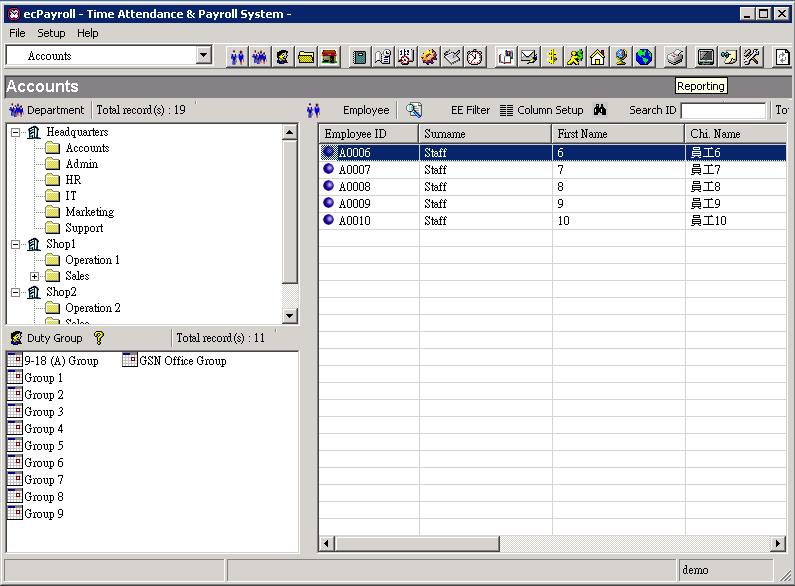

Click

the [Reporting] button from the main

screen toolbar.

![]()

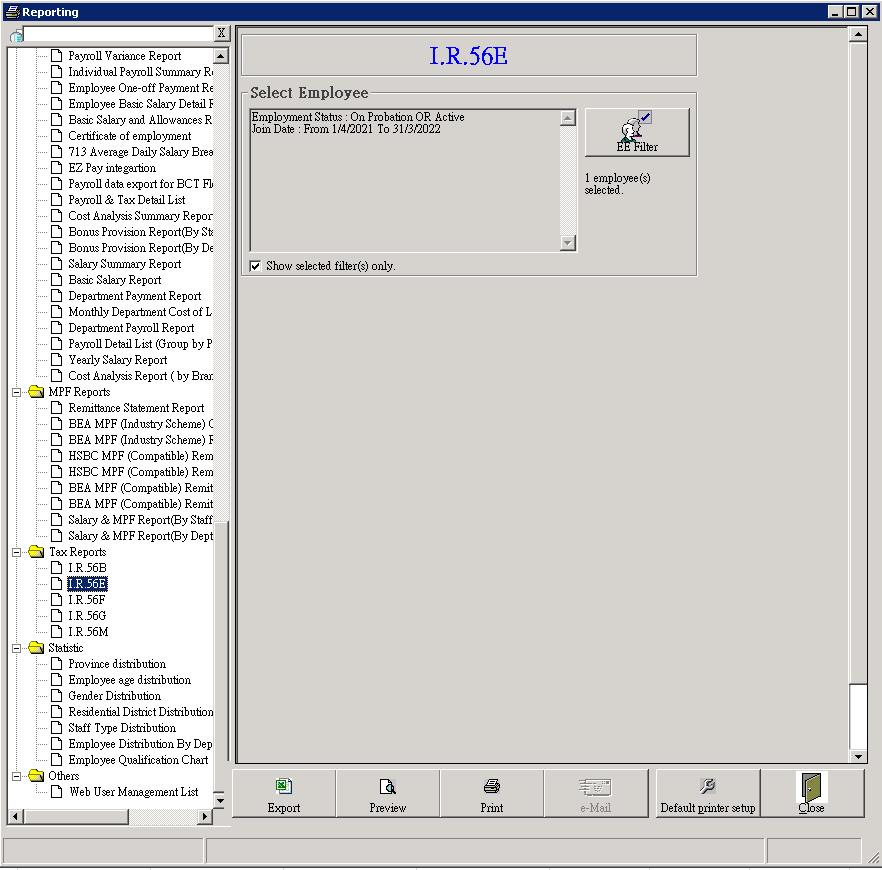

2

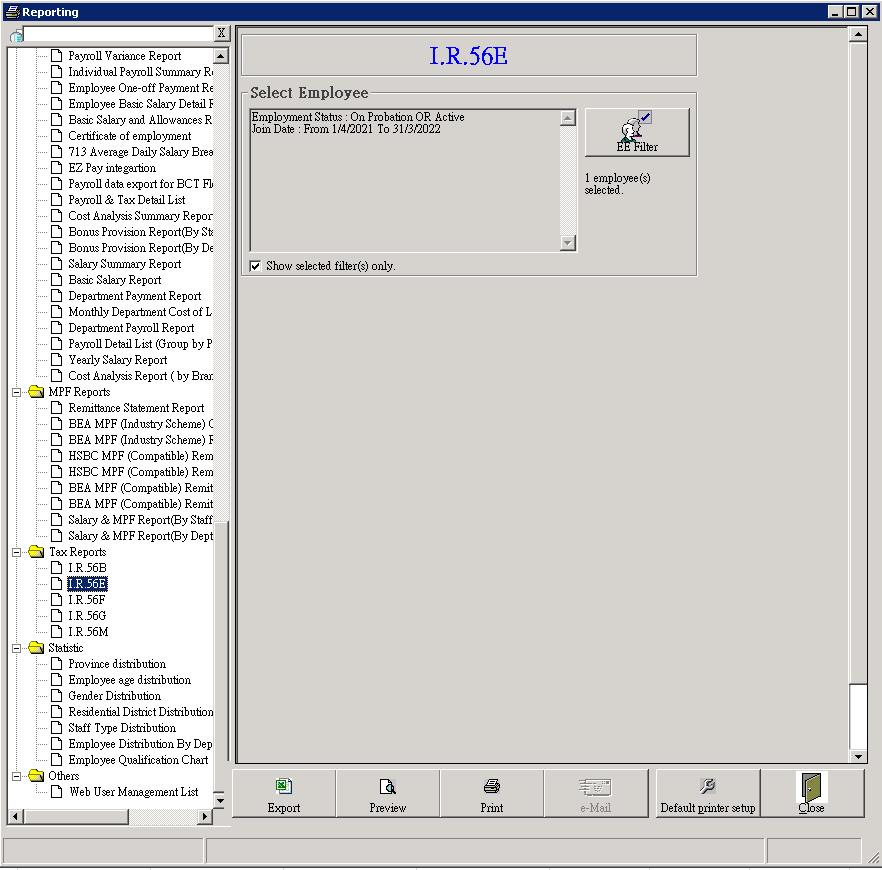

From

the report menu, select “IR56E”

under “Tax Reports” category

![]()

3

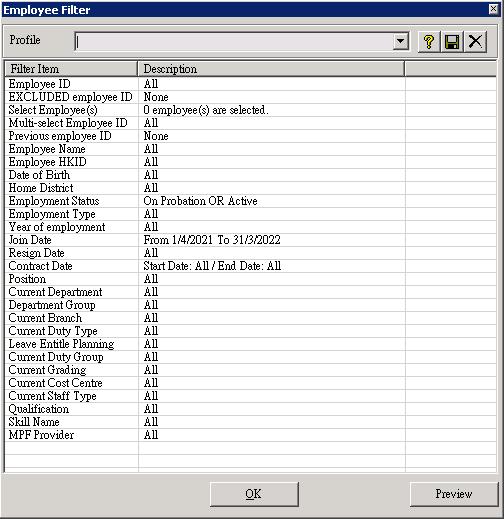

Click

the [ EE Filter ] button to select the new join staff(s) who are

required to generate IR56E form. The following filter criteria may be useful

for you to filter out the required new join staff(s) :

3.1

“Employee

ID”

3.2

“Employee

Name”

3.3

“Employee

HKID”

3.4

“Employment

Status”

3.5

“Join

Date”

3.6

“Select

Employee(s)”

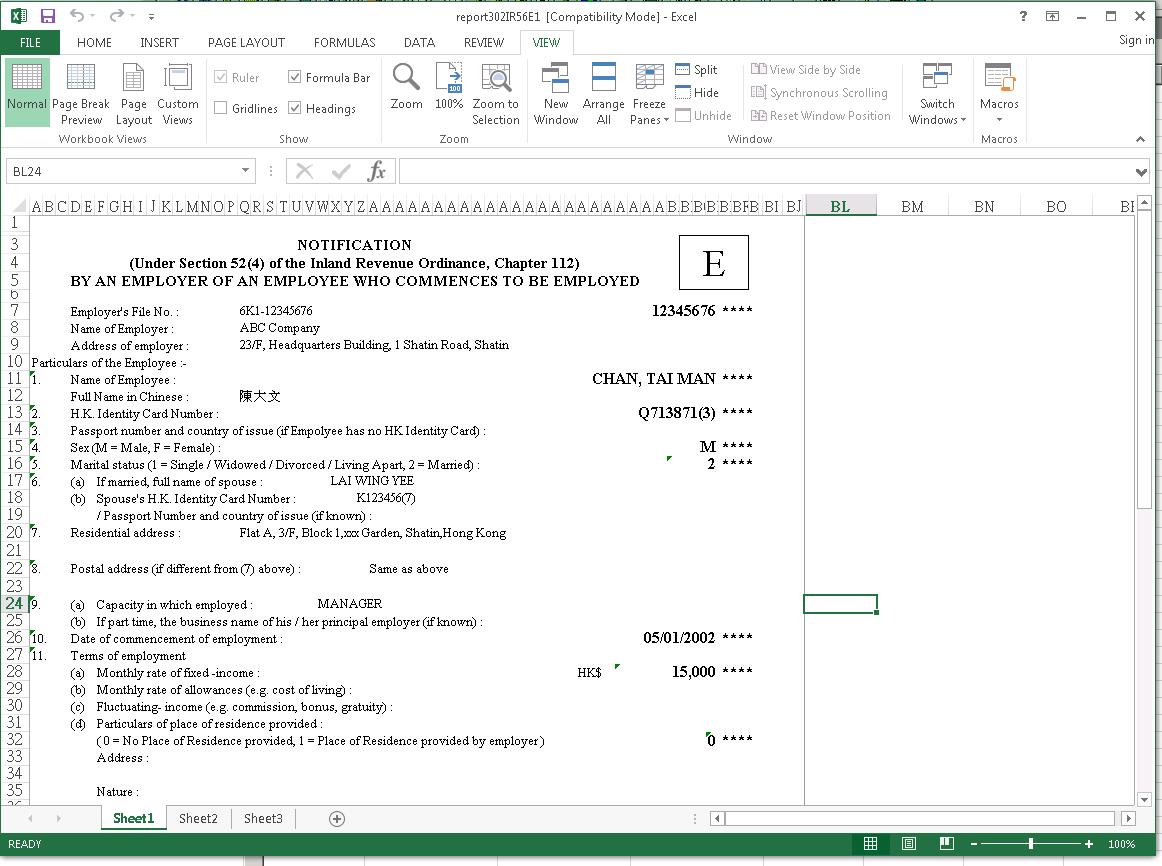

4

Click

the [Export] button to export the

IR56E form(s) to Excel. Or click the [Print]

button to print out the form(s) directly to printer.

5

Finished.

See also

l

Export IR56B data for “IRD IR56B software”